The beauty of investing in commercial real estate at its most simple: acquiring a tangible asset, enhancing it, getting it to cash flow, and letting the market push its value to great heights. With the proper foresight, team, and focus, a savvy investor can spin a small amount of capital into a significant chunk in a short amount of time. The driving force behind why commercial real estate is such an attractive investment vehicle is that these tangible assets produce income, can wildly appreciate, and can be forced to a higher value.

I am going to provide a roadmap illustrating the concept of turning $150,000 into $1,000,000 through commercial real estate investing.

One caveat: what I present here is a SIMPLIFIED rendition of the process. Financing, acquiring, renovating, leasing, and selling any piece of commercial real estate is market-based. What is true in Charleston might be way off base in Orange County, and market conditions factor heavily into the success of any investing journey. It also requires intense focus on your end goal, which most people don’t have the time or capacity to see through.

But in theory, investing in CRE right now is as attractive as it’s ever been, and this tactic has been utilized by investors across the globe for decades.

Let’s dive in!

Step One

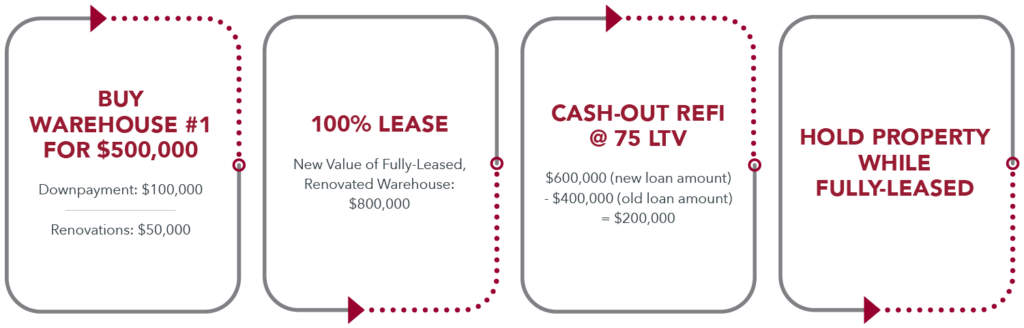

The first step of this process is to source and acquire a value-add warehouse for around $500,000. “Value-Add” essentially means there is potential to force value (through renovations, adding tenants, expanding, etc). We’ll use the initial $150,000 to fund this—$100,000 for the downpayment and $50,000 to renovate the vacant property. The goal in renovating is to fix any major issues first, and then look at cosmetic enhancements that will get the building ready to lease. Repairs that aren’t incredibly expensive but still add major value to industrial buildings include: paint, enhanced roofing, HVAC upgrades, lighting, and landscaping. Now we need to get it leased! Source a reputable tenant at or above market rate. Once at 100% occupancy, we’ll get it appraised with the goal of refinancing the original loan and drawing out the leftover cash (Cash-Out Refi). A Cash-Out Refi can be a complex process, but we’ll simplify it here: get a new loan for the current value of the property, pay off the old loan, take out the remaining cash.

Assuming the new value of our renovated, fully-occupied warehouse is $800,000, the refinance will provide up to 75% loan-to-value (LTV), which means our new loan is $600,000. We’ll use that to pay off the original loan ($400,000), and be left with $200,000. And if we did it right, we’ll still be producing positive cash flow on a monthly basis from our tenant, even though the new loan is bigger. We’ll hold onto this asset for the time being, letting it pay us a little monthly passive income while it appreciates and the loan amortizes.

Step Two

Now, we source and acquire a slightly pricier value-add warehouse using the $200,000 we received from the Warehouse #1 cash-out-refi. And let’s use a similar process: complete the most valuable/efficient repairs for the vacant warehouse and fill with reputable tenant. A note here: fully occupied warehouses are valued much high than vacant warehouses. Might be stating the obvious, but one of the main reasons CRE is so attractive is that tenants pay rent, which equates to passive monthly income. So, once we have a reputable tenant in Warehouse #2, we take a look at the market and realize investor appetite for fully-leased warehouses is sky high. Let’s sell this one! It appraises for $950,000 and that’s what we go under contract for. We pay off our loan of $600,000 and are left with $350,000 free-and-clear profit. Now we’re rolling!

Step Three

Same general principle but at a larger scale. We use the funds from the sale of Warehouse #2 ($350,000) to acquire and renovate a larger vacant warehouse. In this case, we’ll do some cosmetic repairs, but we’ll focus on putting up a few demising walls turning it into a multi-tenant property. This will allow for a higher total rent to be achieved. Again, the market is hot so let’s liquidate our properties! Warehouse #3 appraises for $1,450,000 and sells for that amount. We pay of the $800,000 loan and are left with $650,000 of free-and-clear profit.

Remember Warehouse #1? We’ve been collecting income on it for a few years and now its time to sell that too. Given 4% appreciation over a 4 year period, the new appraised value is $900,000 and it sells for that amount. We pay off the cash-out refi loan of $550,000, and are left with $350,000 of free-and-clear profit.

$650,000 + $350,000 = $1,000,000

Conclusion

There is your million! Again, this is an overly simplified version of the entire process. There are a variety of factors that we haven’t even touched (due diligence, permitting, banks, tax implications, construction costs, marketing, to name a few). But when commitment is paired with smart decision making and the right team behind you, results like this aren’t out of reach. I’ve helped people achieve this. I love commercial real estate as an investment vehicle, and look forward to sharing more!

Stay Updated

Interested in our latest property listings, unique market intel, and a variety of commercial real estate resources? Get a consistent dose delivered to the top of your inbox!