Introduction

Charleston office market fundamentals are strong relative to other major metros. But while leasing and sales in the office sector are stable, we have to keep a close eye on how the Charleston market will fare in uncertain economic times in 2023 and beyond.

- Overall office vacancy in the market still remains at 10% or below, which reflects a healthy office supply and demand balance. While many office tenants are downsizing and some office assets are headed for trouble, Class-A leasing in prime locations remains strong. Tenants are willing to pay more for amenities and a superior workplace for their employees. Larger markets across the country tell a different story (soaring vacancies and empty headquarter buildings). But our smaller average tenant size and location desirability has helped us outpace some of this downturn.

- Charleston continues to struggle with recruiting new large office users. Most of our large office employers are homegrown.

- There will be a large chunk of Class-A office space delivered to the market in 2023, but nothing significant in the pipeline beyond that. The lack of new construction will be good for the newly completed Class-A office buildings by limiting competition moving through 2023, but it is a bit worrisome because of the length of time it takes for large new office buildings to get designed, permitted and developed (4+ years). We should see a period of swift lease-up and then rents will tend to increase because of the lack of new supply soon after that.

- Rising interest rates will continue to impact the sales sector by limiting the availability of debt to buyers. But even with interest rates rising, there does not seem to be upward pressure on office cap rates in the Charleston market.

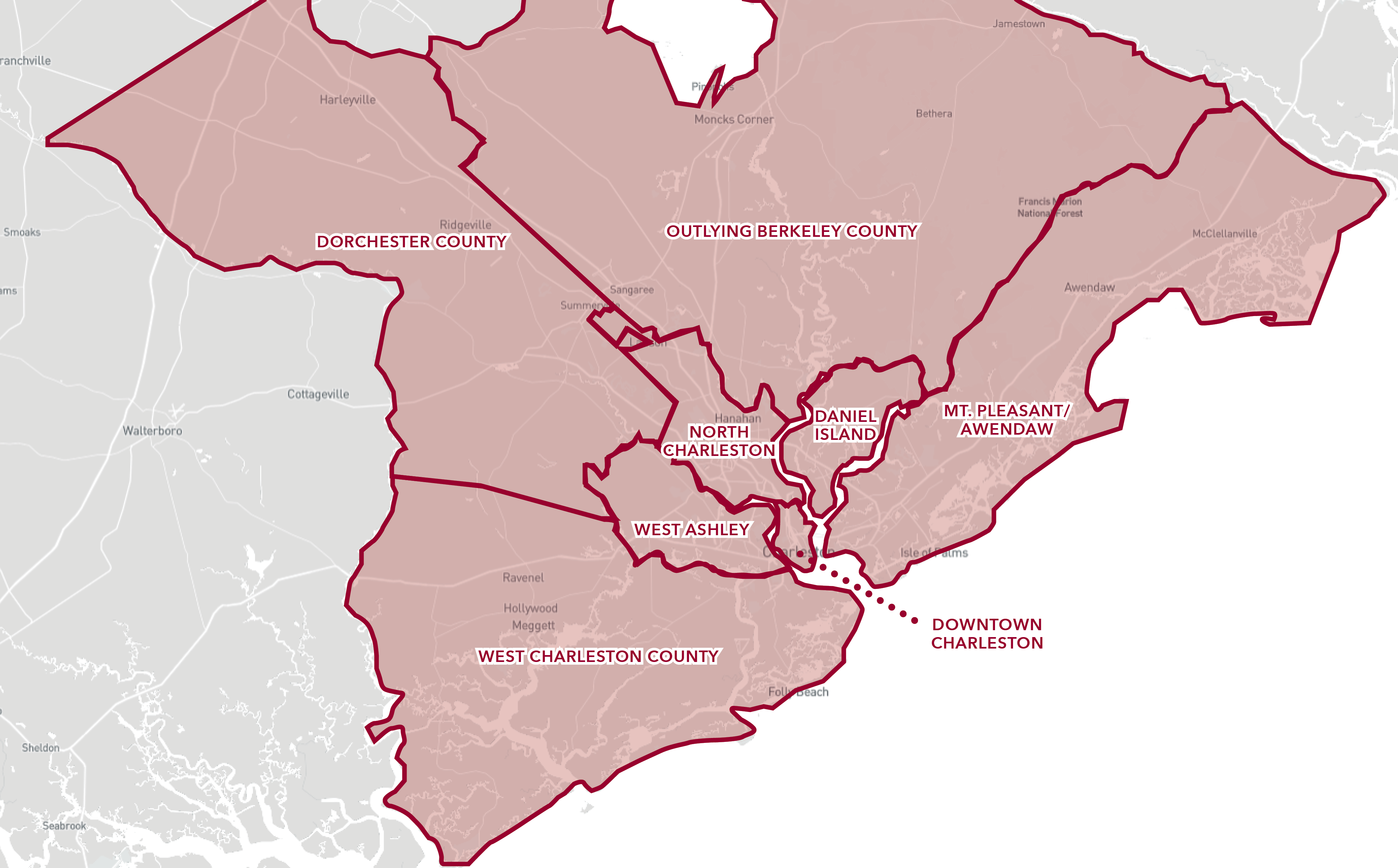

Submarket Overview

The Charleston-area commercial real estate market is broken down into 8 distinct submarkets: Daniel Island, Dorchester County, Downtown Charleston, North Charleston, Outlying Berkeley County, West Ashley, West Charleston County, and Mt. Pleasant/Awendaw.

There is nuance between each locality and different phenomena that impact the health and status of each. Each submarket is unique, and they all come together to create the landscape for Charleston’s commercial real estate community.

A complete breakdown on submarket stats is below:

Office Redevelopment in Charleston

A viable alternative to new contstruction?

Office redevelopment is the process of renovating or restructuring an existing office space to make it more functional, efficient, and aesthetically pleasing. This can involve a variety of activities, such as remodeling the layout of the space, updating the finishes and fixtures, adding new technology and amenities, and making improvements to the building’s infrastructure. Office redevelopment is often undertaken to modernize an older office space, to adapt to changing business needs, or to improve the work environment for employees. It can be a complex process that involves a variety of stakeholders, including architects, designers, contractors, and facility managers.

Why would a building owner pursue a redevelopment project?

To Attract & Retain Tenants

This may involve updating the appearance and amenities of the space, as well as improving the building’s infrastructure and energy efficiency, all of which can help to improve employee satisfaction and productivity.

To Increase Property Value

Modernization will make it more attractive to potential buyers or tenants.

To Adapt to Changing Business Needs

As businesses evolve, their needs for office space may change. Landlords may undertake office redevelopment in order to adapt the space to better meet the needs of current or future tenants.

To Capitalize on Location

Redevelopment opportunities are often in “infill” locations near population hubs, infrastructure, and amenities. Redevelopment in a prime location can pay dividends.

Proof of Concept

Featured Listings

Here at Lee & Associates, we are proud to play an integral role in the amplification of the Charleston office market.

Our firm’s listings embody the state of the market: new, in-demand, and adaptive to the ever-changing landscape.

Here is a sampling of some available, Class-A properties that we currently represent in the Charleston area.

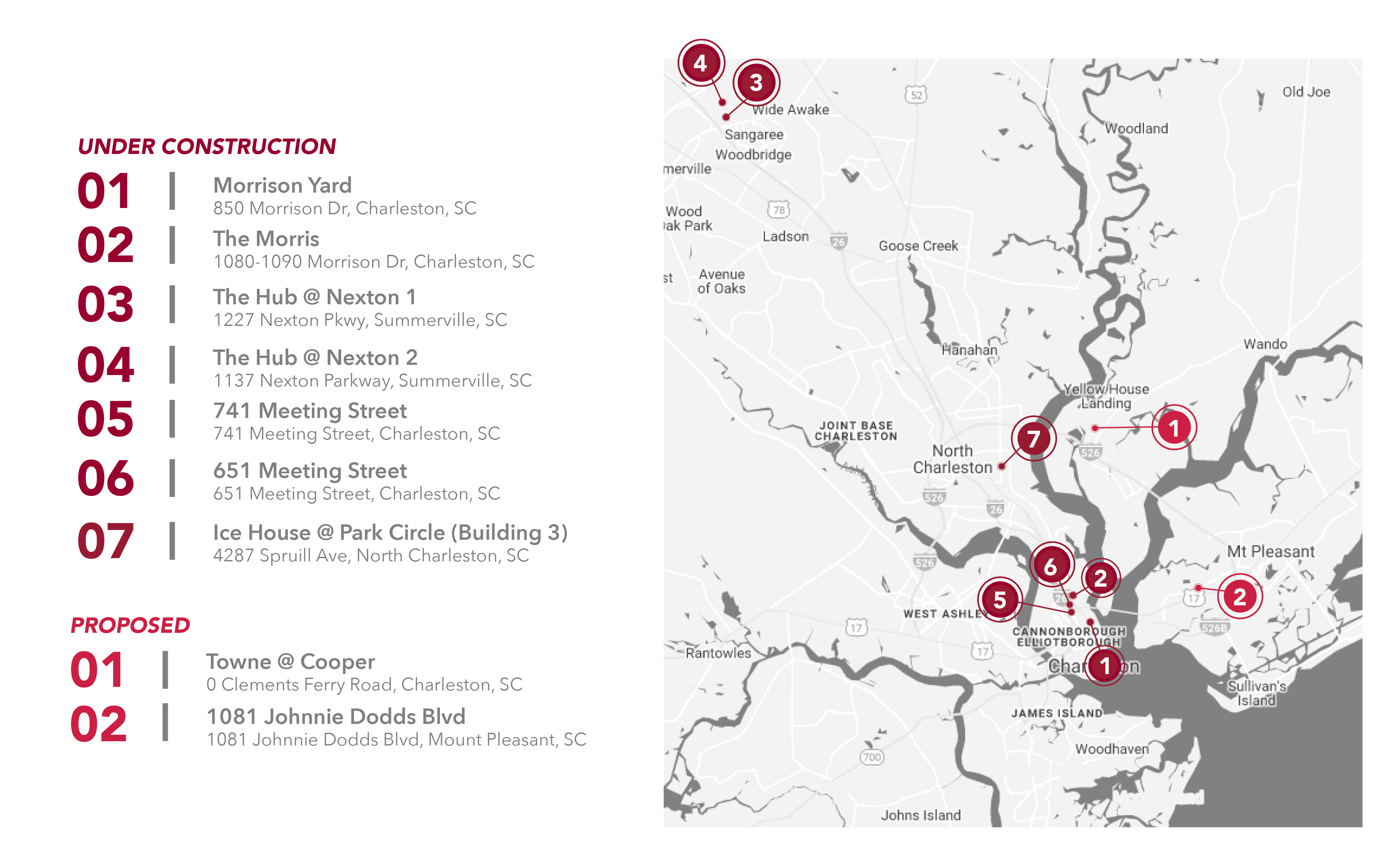

Office Property Map

Under Construction

Morrison Yard - 850 Morrison Drive, Charleston

Status: Under Construction

RBA: 145,000 SF

Floors: 12

Asking Rate: $42.00 - $48.50/FS

Available: 39,947 SF

Occupancy: 72.5%

Tenants: Pinnacle Bank, Parker Poe Adams & Bernstein, Bond Street Advisors, JLL, Blaze Partners, CBI, Origin Development

Developer: Origin Development Partners

Delivery Date: Q1 2023

The Morris - 1090 Morrison Drive, Charleston

Status: Under Construction

RBA: 115,000 SF

Floors: 3

Asking Rate: $42.00 - $46.00/FS

Available: 115,000 SF

Occupancy: 6.5%

Tenants: undisclosed

Developer: Cowan Nakios Group, LLC

Delivery Date: Q4 2022

The Hub @ Nexton 1 - 1227 Nexton Pkwy, Summerville

Status: Under Construction

RBA: 30,000 SF

Floors: 2

Asking Rate: $27.50/NNN

Available: 30,000 SF

Occupancy: 0%

Tenants: None

Developer: SL Shaw

Delivery Date: Q4 2023

The Hub @ Nexton 2 - 1137 Nexton Pkwy, Summerville

Status: Under Construction

RBA: 20,000 SF

Floors: 2

Asking Rate: $27.50/NNN

Available: 20,000 SF

Occupancy: 0%

Tenants: None

Developer: SL Shaw

Delivery Date: Q4 2023

741 Meeting Street, Charleston

Status: Under Construction

RBA: 29,985 SF

Floors: 3

Asking Rate: $34.50/NNN

Available: 15,651 SF

Occupancy: 47.8%

Tenants: Undisclosed

Developer: Middle Street Partners

Delivery Date: Q4 2022

651 Meeting Street, Charleston

Status: Under Construction

RBA: 29,985 SF

Floors: 3

Asking Rate: $34.50/NNN

Available: 15,651 SF

Occupancy: 47.8%

Tenants: Undisclosed

Developer: Middle Street Partners

Delivery Date: Q4 2022

Proposed

Towne @ Cooper - 0 Clements Ferry Road, Charleston

Status: Proposed

RBA: 35,800 SF

Floors: 2

Asking Rate: $28.50/NNN

Available: 35,800 SF

Occupancy: 0%

Developer: Flagship Healthcare Properties

Construction Start: Q1 2024

1081 Johnnie Dodds Blvd, Mt. Pleasant

Status: Proposed

RBA: 35,000 SF

Floors: 3

Asking Rate: $28.00 - $29.50/NNN

Available: 35,000 SF

Occupancy: 0%

Developer: Amplify

Construction Start: Q4 2022