Introduction

Recent headlines on the office sector are a little unnerving. Unprecedented vacancy, crumbling values, major downsizing, work-from-home debates, and economic unease are all major themes. This leaves no question that office in 2023 is struggling. But to what depths will it sink? And are all markets feeling the effect similarly?

Let’s take a look at a few unsettling facts that provide a bit of context:

- 10 straight months with Interest Rate hikes in 2022-2023, with two more scheduled for the rest of this year.

- Office values in Manhattan, Houston, and Philadelphia could plunge by 40% or more by 2024.

- Several corporate giants have moved to tougher enforcement of their return-to-office mandates, including Chipotle, Farmers Insurance, Lyft, Disney, Snapchat, Meta and Amazon.

- $44.6 billion of U.S. office loans come due by the end of 2024.

- In May, the vacancy rate for offices reached a record high of 13%, surpassing previous peaks during the Great Recession of 2007-2009.

- National office rent growth for the past three years has hovered around 1%, according to CoStar data. By comparison, the U.S. inflation rate averaged 4.7% in 2021 and 8% in 2022.

- CMBS special servicers of foreclosed properties are having a hard time getting their money back. Recent distressed office sales have averaged $74/SF versus the going market rate of $162/SF.

A decidedly gloomy outlook.

BUT DESPITE ALL OF THIS, Charleston looks just fine. For the past decade, our tertiary market has a enjoyed unwavering population growth, more than 2x the national average. This growth has been THE major reason why Charleston has showed resiliency in the commercial real estate landscape. Office activity is admirable and we haven’t shifted to panic mode (yet…). In the mean time, investors and occupiers continue to keep Charleston on their shortlists, as people continue to lay down roots at a record pace.

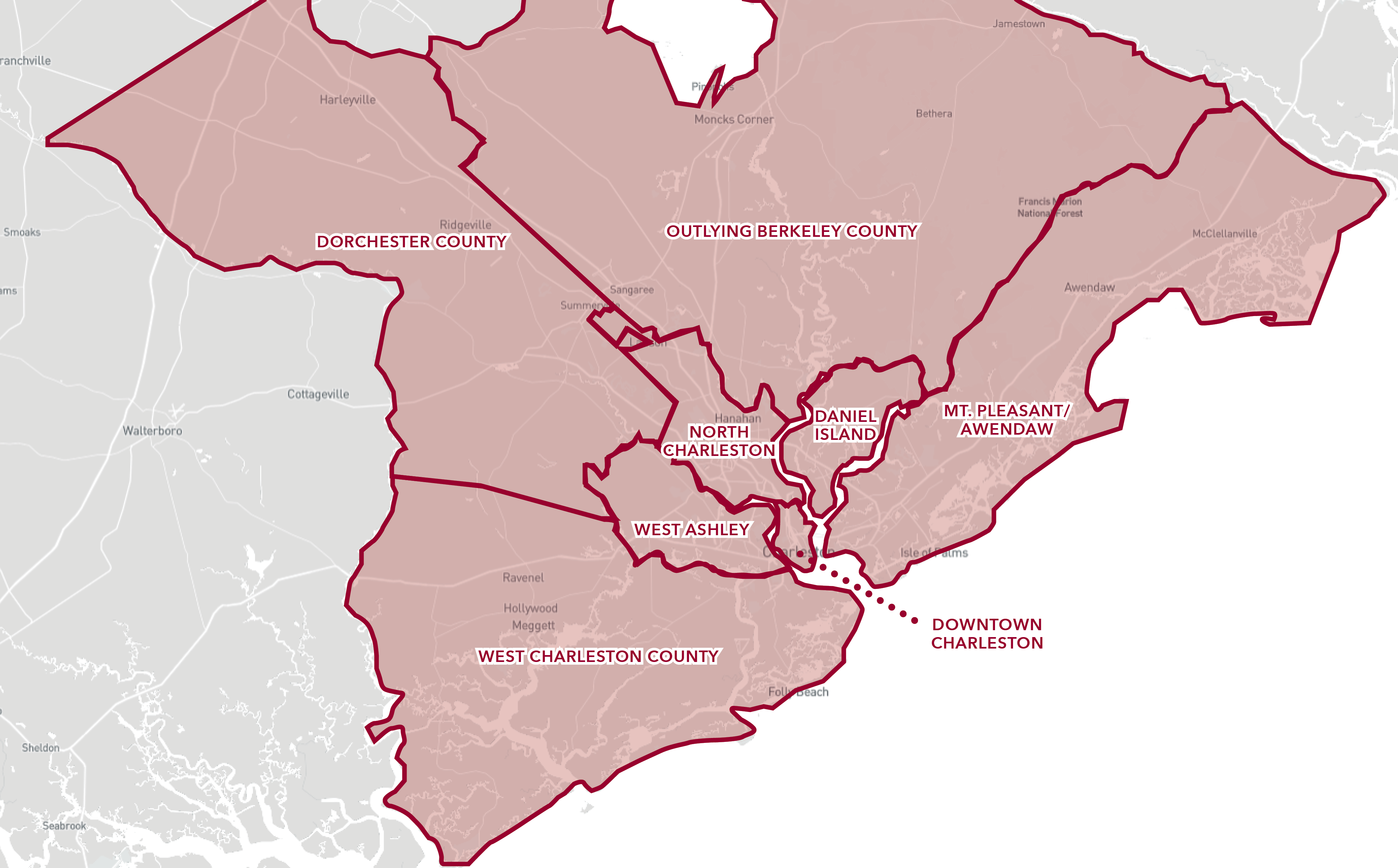

Submarket Overview

The Charleston-area commercial real estate market is broken down into 8 distinct submarkets: Daniel Island, Dorchester County, Downtown Charleston, North Charleston, Outlying Berkeley County, West Ashley, West Charleston County, and Mt. Pleasant/Awendaw.

There is nuance between each locality and different phenomena that impact the health and status of each. Each submarket is unique, and they all come together to create the landscape for Charleston’s commercial real estate community.

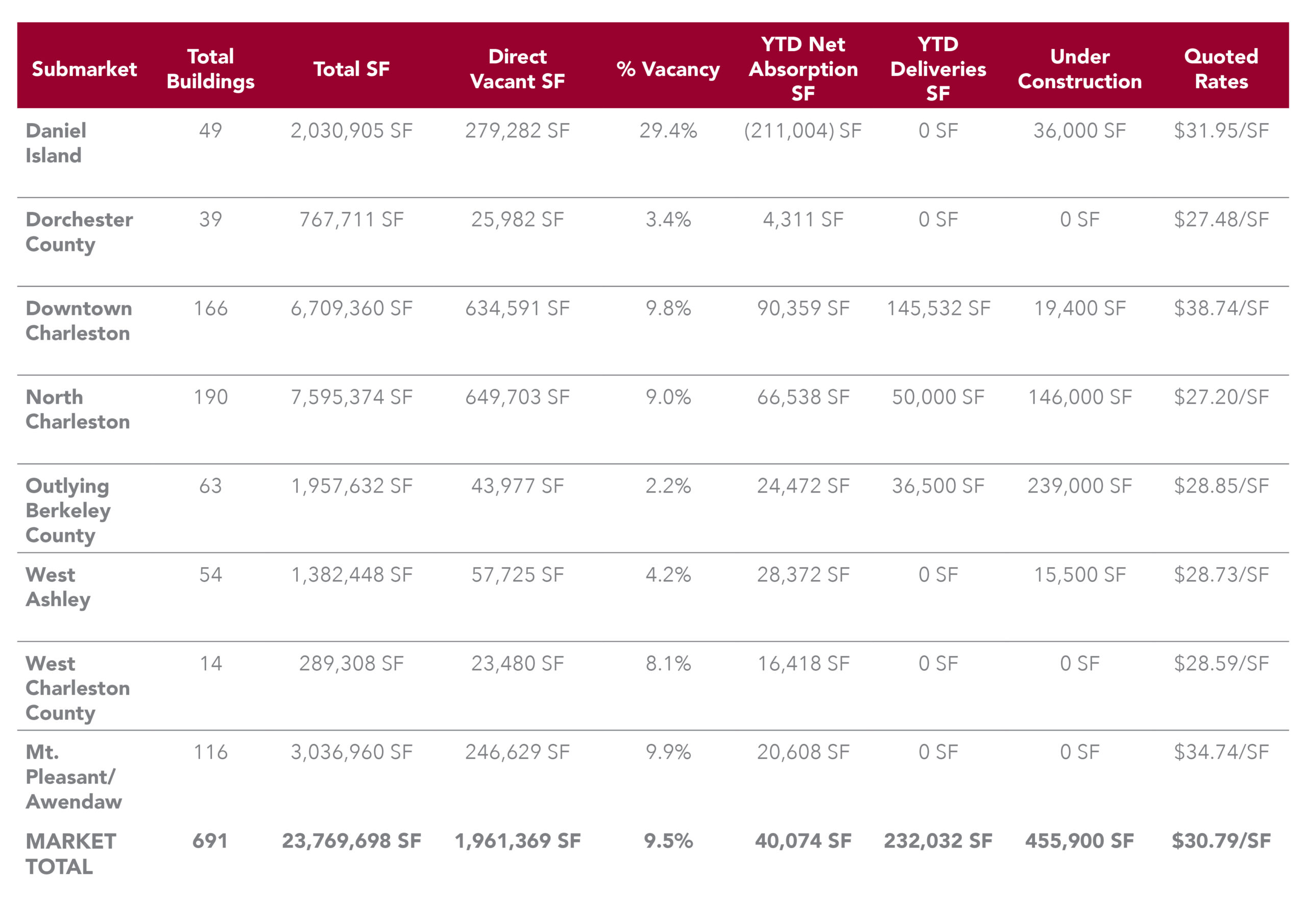

A complete breakdown on submarket stats is below:

National Outlook vs. Charleston

How has Charleston Defied Broader Office Market Trends?

The Charleston commercial real estate office market stands as a shining example of resilience and dynamism in contrast to the broader U.S. office market. Nationally, the office market has faced challenges due to changing work trends, such as remote working, and economic uncertainties like increasing interest rates and sky-high inflation. However, Charleston has managed to buck the trend.

One of the primary factors contributing to Charleston’s resilient office market is its unique blend of lifestyle, culture, and economic opportunities. The city is attractive to both businesses and individuals, with a burgeoning tech sector and a lively historical downtown area.

While almost every major indicator has looked gloomy nationwide, Charleston’s figures look a bit more promising, and we’ve seen significant activity in office, particularly in the tech and healthcare sectors. The city’s lower operating costs compared to major metros and the quality of life have led businesses to either relocate or expand.

Charleston Outshines

Despite national headwinds, Charleston’s commercial real estate market for offices exemplifies resilience and vitality. Major construction projects and recent expansions highlight the city’s thriving environment. Charleston’s blend of culture, lifestyle, and strategic location continues to attract businesses, underpinning the sustained growth of its office market with continued investment and development. Charleston has skirted major effects of office downturns and interest rate hikes before, and has emerged relatively unscathed once again.

Here are a few examples that point to the continued growth of our market:

Featured Listings

In partnership with Healthcare Realty Trust, our firm is offering a handful of prime medical office lease listings in Charleston, SC. The major REIT entrusted us to help add value to their portfolio, recognizing the potential of Charleston as an emerging medical office market. These modern, strategically-located lease opportunities will cater to a wide variety of healthcare professionals, and are available now.

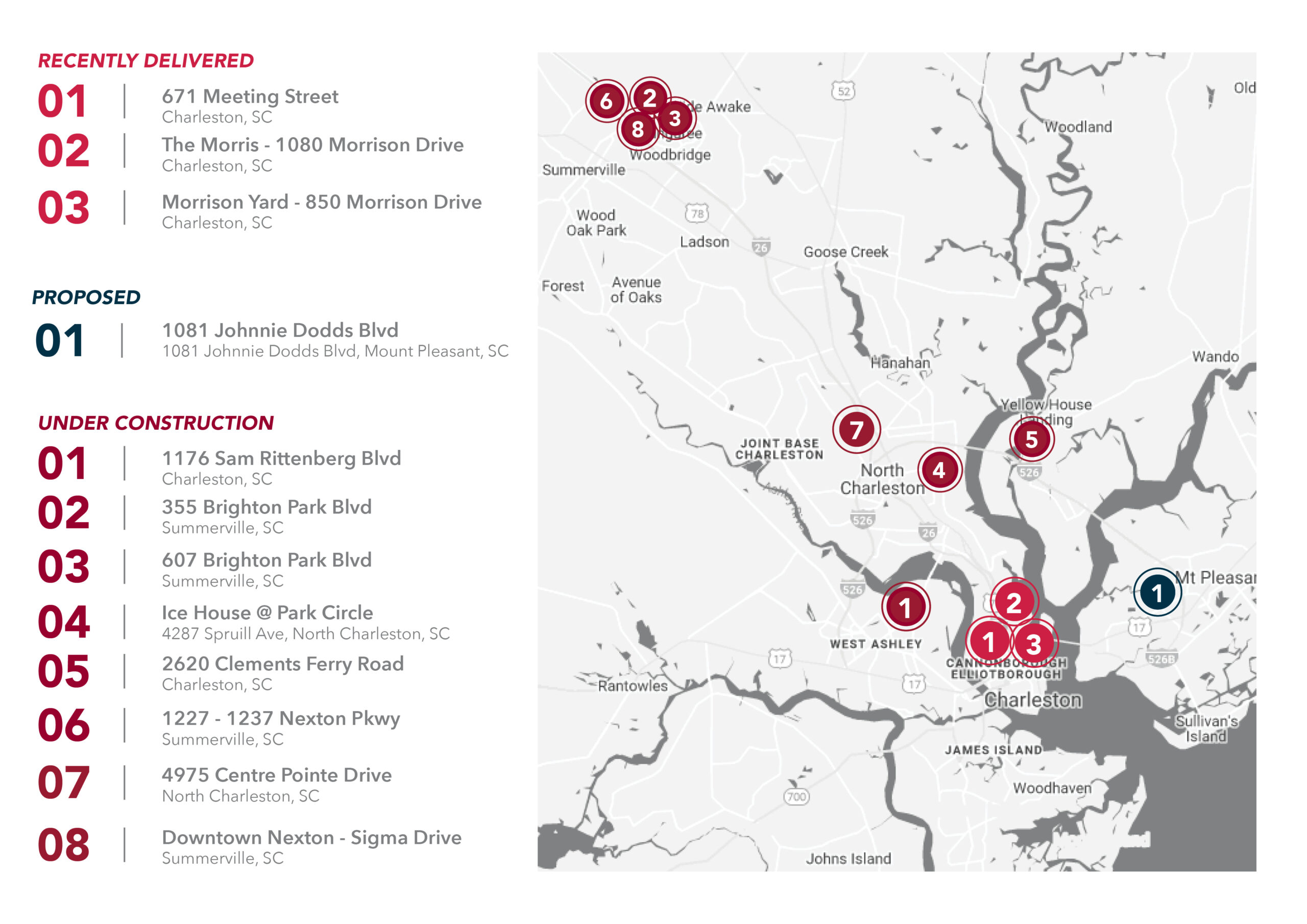

Office Property Map

Under Construction

Northbridge Executive Park, 1176 Sam Rittenberg - Charleston, SC

Status: Under Construction

RBA: 15,500 SF

Asking Rate: TBD

Available: 15,500 SF

Occupancy: 0%

Tenants: None

Developer: Thaynes Capital

Delivery Date: Q4 2023

Atelier Downtown Nexton - 355 Brighton Park Blvd - Summerville, SC

Status: Under Construction

RBA: 18,000 SF

Asking Rate: TBD

Available: 18,000 SF

Occupancy: 0%

Tenants: None

Developer: Sharbell Properties

Delivery Date: Q4 2023

The Yard @ Nexton - 607 Brighton Park Blvd, Summerville

Status: Under Construction

RBA: 22,500 SF

Asking Rate: TBD

Available: 22,500 SF

Occupancy: 0%

Tenants: None

Developer: Nash-Nexton Holdings

Delivery Date: Q1 2024

Ice House @ Park Circle - 4287 Spruill Ave - North Charleston, SC

Status: Under Construction

RBA: 26,000 SF

Asking Rate: $29.50/NNN

Available: 26,000 SF

Occupancy: 0%

Developer: Cobalt Property Group

Delivery Date: Q4 2023

Towne @ Cooper River - 2620 Clements Ferry Road - Charleston, SC

Status: Under Construction

RBA: 36,000 SF

Asking Rate: $29.50/NNN

Available: 36,000 SF

Occupancy: 0%

Tenants: None

Developer: Flagship MOB

Delivery Date: Q4 2024

The Hub @ Nexton - 1227-1237 Brighton Pkwy - Summerville, SC

Status: Under Construction

RBA: 88,000 SF

Asking Rate: $33.00/NNN

Available: 79,000 SF

Occupancy: 10.2%

Tenants: Holiday Ingram, KAJJ SC2

Developer: SL Shaw

Delivery Date: Q4 2023

Developer: Flagship MOB

Delivery Date: Q4 2024

Uptown @ Centre Pointe - 4975 Centre Pointe Drive - North Charleston, SC

Status: Under Construction

RBA: 100,000 SF

Asking Rate: TBD

Available: 100,000 SF

Occupancy: 0%

Tenants: None

Developer: RealtyLink

Delivery Date: Q4 2024

Downtown Nexton - Sigma Drive, Summerville

Status: Under Construction

RBA: 110,000 SF

Asking Rate: TBD

Available: 110,000 SF

Occupancy: 0%

Developer: Sharbell Properties

Delivery Date: Q4 2023

Proposed

1081 Johnnie Dodds Blvd - Mt. Pleasant, SC

Status: Proposed

RBA: 35,000 SF

Floors: 3

Asking Rate: $28.00 - $29.50/NNN

Available: 35,000 SF

Occupancy: 0%

Developer: Amplify

Construction Start: Q4 2023

Recently Delivered

Morrison Yard - 850 Morrison Drive - Charleston, SC

Status: Delivered

RBA: 145,000 SF

Floors: 12

Asking Rate: $42.00 - $48.50/FS

Available: 39,947 SF

Occupancy: 72.5%

Tenants: Pinnacle Bank, Parker Poe Adams & Bernstein, Bond Street Advisors, JLL, Blaze Partners, CBI, Origin Development

Developer: Origin Development Partners

Delivery Date: Q1 2023

The Morris - 1080 Morrison Drive - Charleston, SC

Status: Delivered

RBA: 115,000 SF

Floors: 3

Asking Rate: $42.00 - $46.00/FS

Available: 115,000 SF

Occupancy: 40%

Tenants: Raptor, CBRE, Fifth Third Bank

Developer: Cowan Nakios Group, LLC

Delivery Date: Q1 2023

651 Meeting Street - Charleston, SC

Status: Delivered

RBA: 10,532 SF

Asking Rate: $35.00/NNN

Available: 10,532 SF

Occupancy: 0%

Tenants: None

Developer: Madison Capital Group

Delivery Date: Q1 2023