Unpacking The Southeast's Sublease Surge

In 2023, Charleston and Savannah's industrial landscape underwent unexpected shifts. This article explores the intriguing correlation between Federal Reserve policies, port activity reductions, and the sudden surge in warehouse subleases, revealing the complex interconnection of global, national, and local factors shaping these pivotal markets.

2023 has seen an unprecedented spike in the sublease inventory of industrial warehouse buildings in two of the America’s bustling port markets: Charleston, SC, and Savannah, GA.

For the uninitiated, a sublease occurs when an existing tenant put all or part of their leased space on the market for lease, while still retaining some rights and responsibilities under the original lease.

This upswing in sublease availability is not just a statistical blip, but speaks volumes about the underlying dynamics of these regional markets. Subleases can be indicative of shifts in business needs, financial strains, or evolving industrial landscapes. These rising numbers in Charleston and Savannah raise pressing questions: What external factors are driving this trend? Is this a temporary phenomenon or indicative of a deeper change in how businesses operate in these areas? As we delve deeper, we’ll explore a few of the complexities that underpin this surge and what it means for the future of these still vibrant industrial markets.

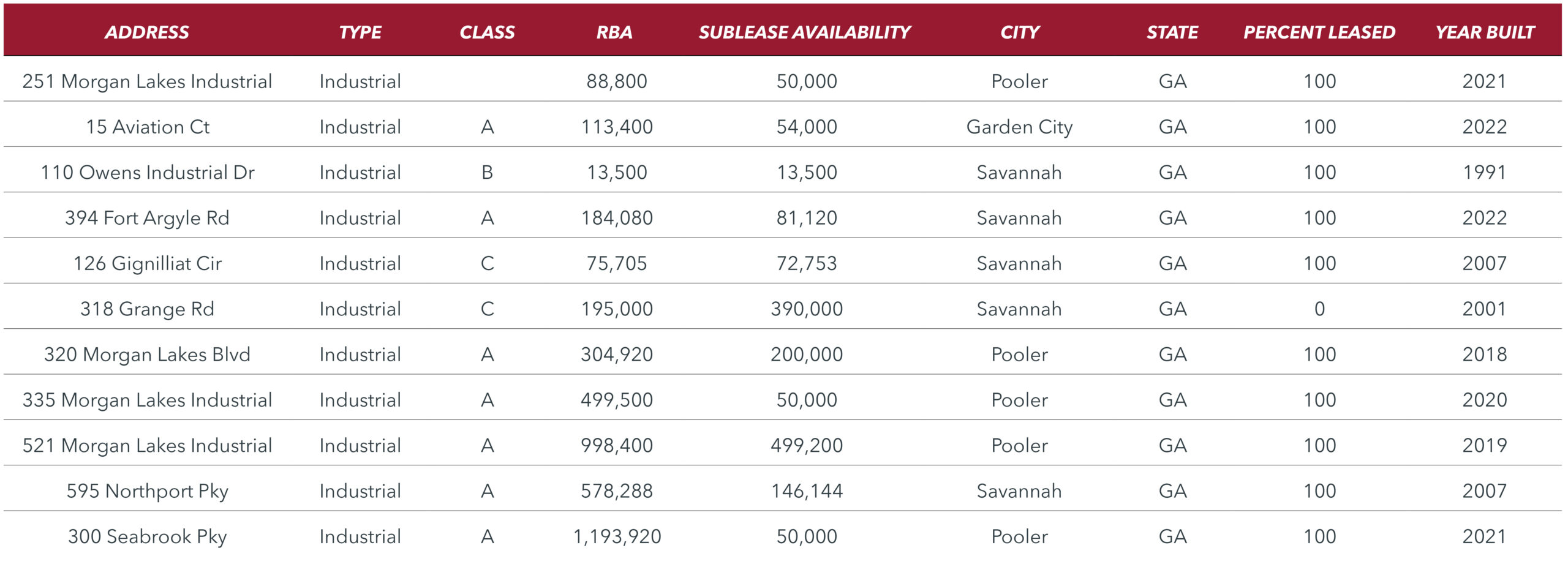

But first, let’s take a look at the current sublease landscape in these markets:

Charleston Market - Current Sublease Listings

Savannah Market - Current Sublease Listings

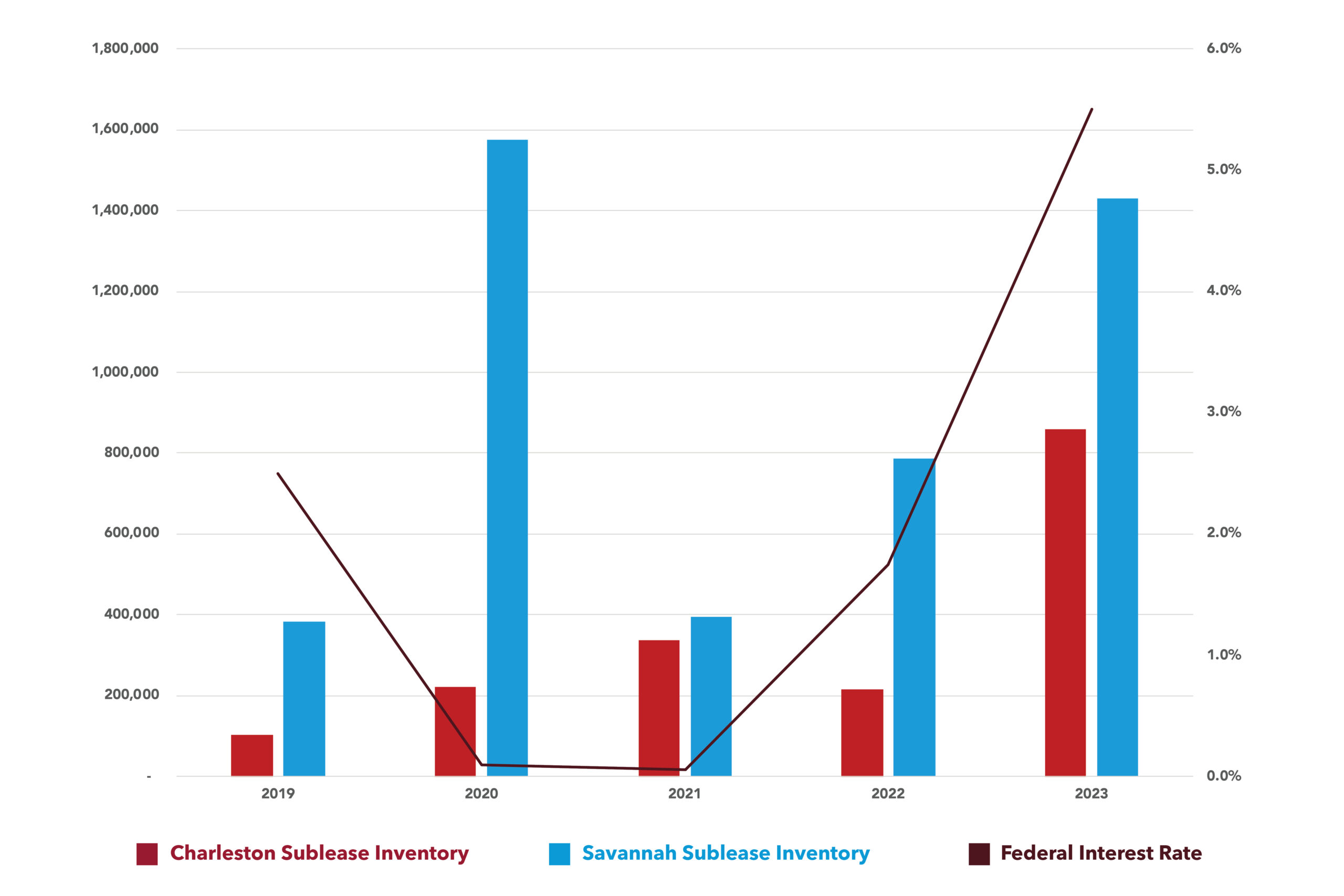

The Fed's Impact

As we look at historical data from the past 5 years, an intriguing correlation emerges between sublease availability and the trajectory of the Federal Interest Rate. As the Federal Reserve embarked on its aggressive push to elevate interest rates, we see a simultaneous spike in warehouse sublease listings in these markets. Specifically at the end of 2022 into 2023 when interest rates rose to their highest levels in decades.

This isn’t mere coincidence. Higher interest rates increase borrowing costs for businesses, making capital-intensive operations, like warehousing, less sustainable for some. As companies find it harder to service debts or access affordable financing, their strategies shift, leading to situations where subleasing becomes a more viable option.

The correlation is a stark reminder that macroeconomic policies, such as those from the Federal Reserve, reach deep local commercial real estate markets. It underscores the profound connection of monetary policy and its tangible, on-the-ground implications in regional markets.

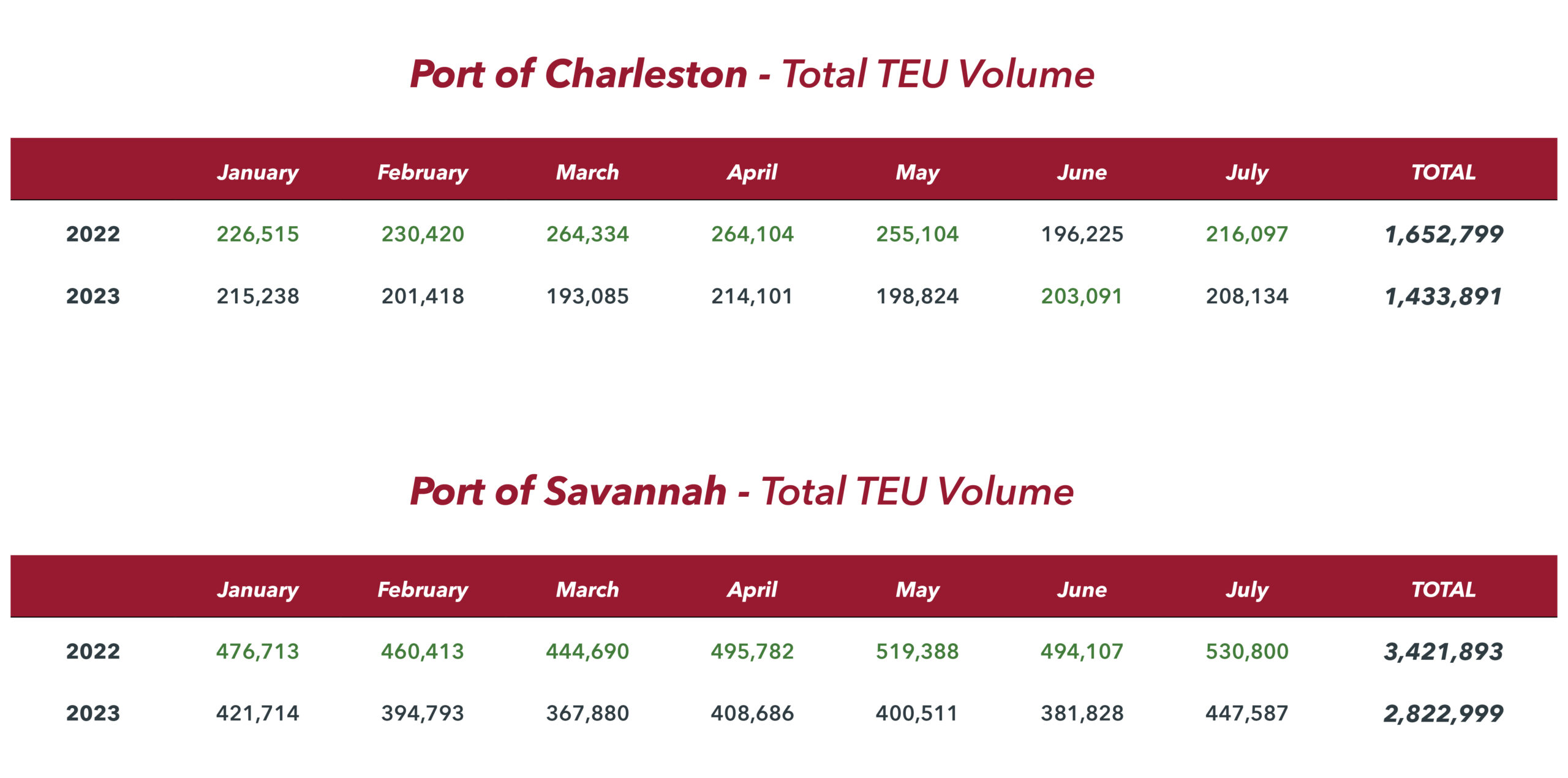

How TEU Volume Influences Sublease Trends

Global trade flows through the Ports of Charleston and Savannah, leaving its mark on their respective warehouse landscapes. A pivotal metric in this story is total TEU, or Twenty-Foot Equivalent Unit, a measure that captures the volume of containers handled by these ports.

Recent figures illustrate a telling trend: The Port of Charleston witnessed a decline from 1,652,799 TEUs in the first seven months of 2022, to 1,433,891 TEUs in the same period of 2023. Similarly, the Port of Savannah experienced a drop from 3,421,893 TEUs in the first 7 months of 2022 to just 2,822,999 TEUs by July-2023

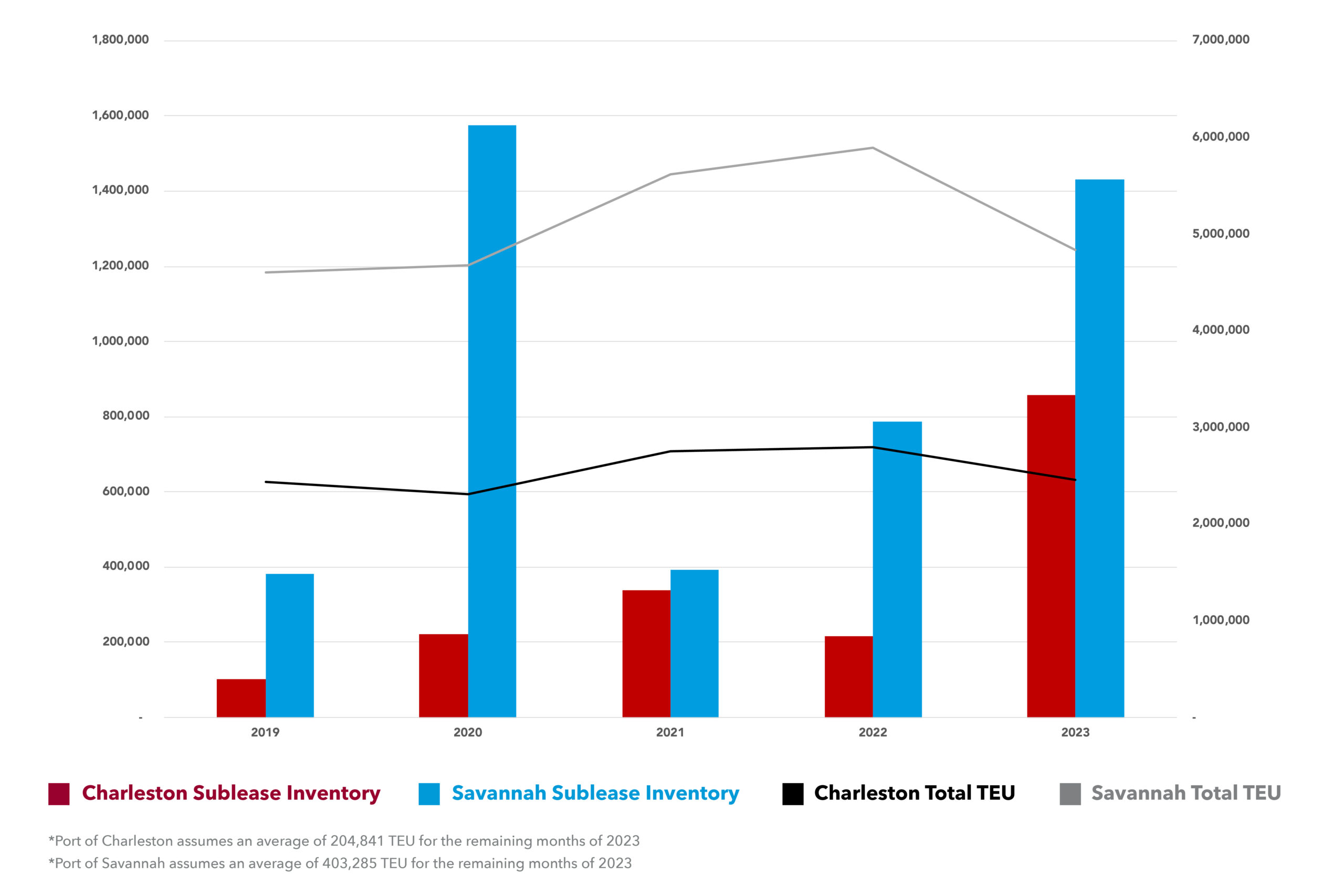

These diminished figures are more than mere numbers; they’re an emblem of reduced port activity, which reverberates throughout these commercial real estate markets. As we see TEU volume decrease, specifically in 2023, the demand for warehousing space adjacent to these ports can taper off leading directly to an uptick in sublease availabilities. This tangible linkage highlights the profound influence of port activity on the ebb and flow of industrial real estate in port-centric markets, and is yet another explanation for the recent spike in sublease availability.

Commercial real estate is impacted by more than just local dynamics. When looking at Charleston and Savannah’s warehouse markets, we can point to a variety of factors that have influenced the recent spike in sublease availability, specifically national monetary policy and global trade dynamics. The tightening grip of the Federal Reserve’s interest rate decisions intertwined with a decrease in port activity, has cast a shadow on the industrial landscape of these markets in 2023.

Both macroeconomic maneuvers and shifts in global trade have had undeniable repercussions on the ground, leading businesses to reevaluate their strategies and space requirements. As we chart the course ahead, it becomes imperative for stakeholders to not only observe these shifts but to anticipate and adapt to the intertwined forces that shape the ever-evolving commercial real estate tapestry of these port markets.